The deal between Saban, Panavision, and Sim is terminated. The business triangle that was supposed to become one stop shop for complex content creation, has vanished means there will be no merging between Pana and SIM.

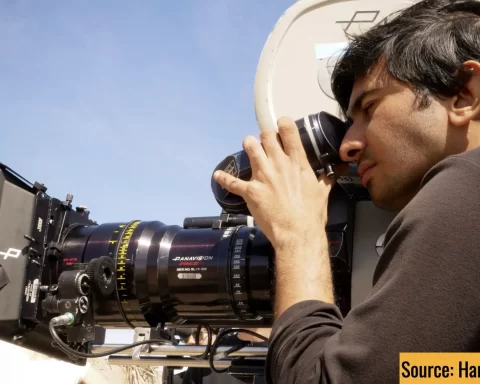

Panavision, SIM, and Saban

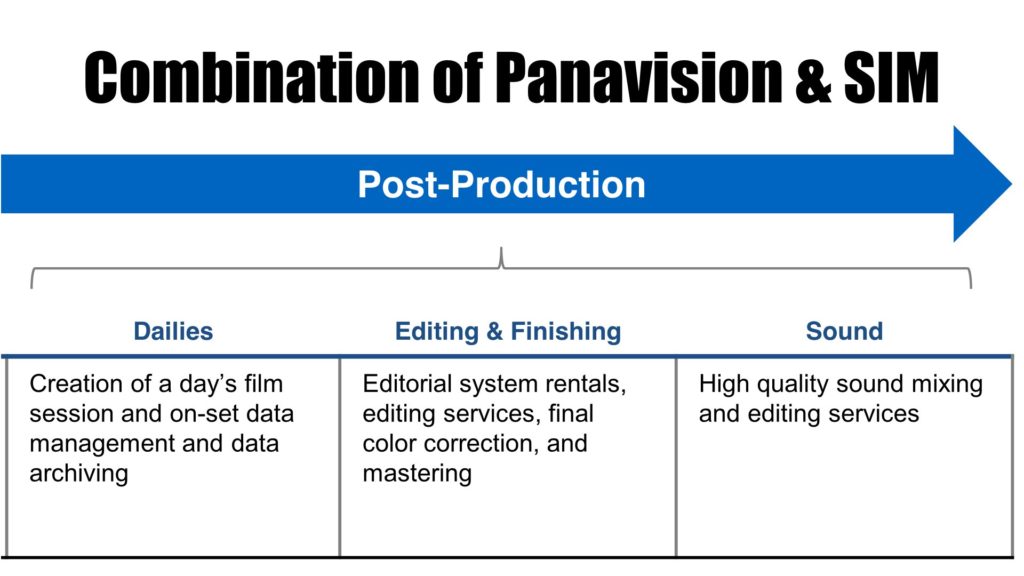

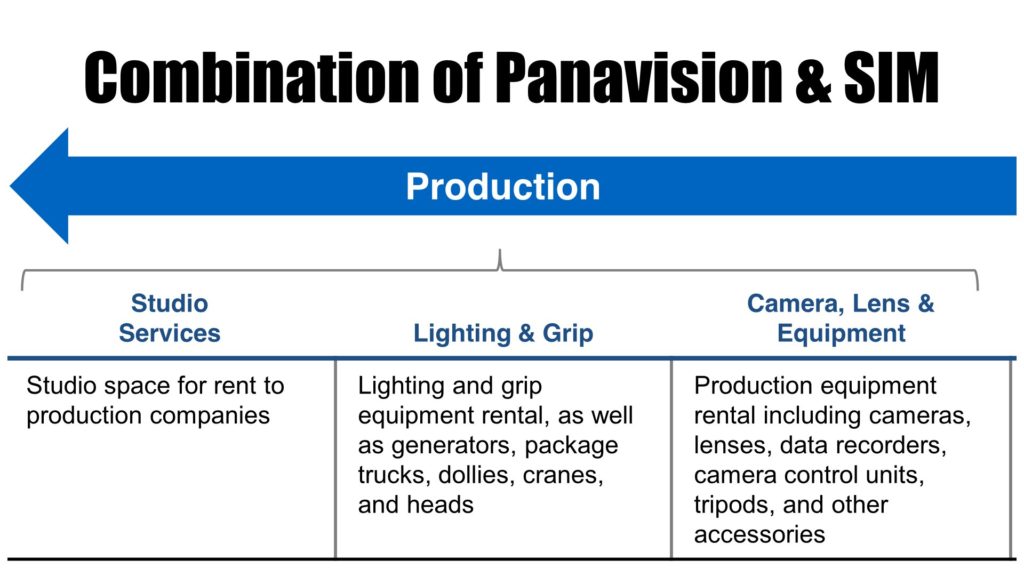

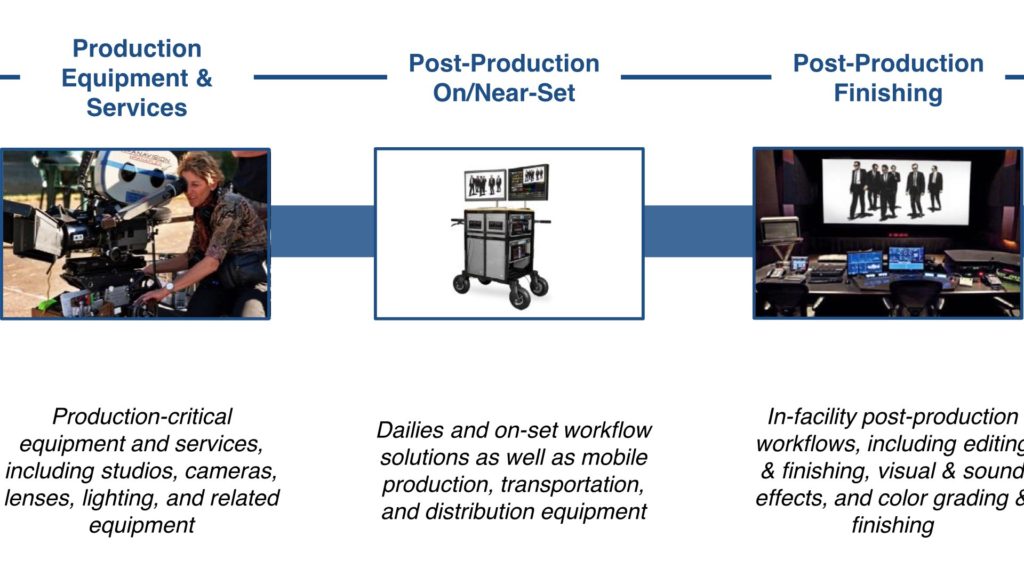

We have reported here previously regarding this joint venture between Panavision and SIM (Sim Video International Inc.) for the purpose of creating a strong brand in order to facilitate and improve high content creation challenges and to create a premier global provider of end-to-end production and post-production solutions to the entertainment industry.

The advantages of the deal: Technology, facilities, and connections

The logic behind this deal was pretty obvious. Every company supposed to bring its own strengths to the table. Panavision owns the technology, Sim has the facilities and Saban brings the connections

Watch slides below which demonstrate the logic behind this deal that was valued at about $622 million:

Termination of the deal

The volatile stock market conditions, combined with delays caused by the partial U.S. government shutdown in January and the resulting difficulty in getting everything completed before the March 31st deadline, leading to the decision to end the agreement.

James Haggarty

James Haggarty, president, and CEO of Sim has released a statement declaring that the agreement between Sim, Panavision, and Saban has been terminated.

As stated by Haggarty: “As you may know, in September 2018, Sim announced that it had entered an agreement to combine businesses with Panavision and Saban Capital Acquisition Corporation; a public shell company that was to acquire both Sim and Panavision and the resulting enterprise would be a public company listed on the NASDAQ stock exchange….I’m writing to inform you that all three parties have decided to terminate the business combination agreement announced last September.

Volatile stock market and U.S government shutdown

The decision to end the agreement was a difficult one because all parties believed in the benefits of this joint venture. However, the volatile stock market conditions, combined with delays caused by the partial U.S. government shutdown in January and the resulting difficulty in getting everything completed before the March 31st deadline, leading to the decision to end the agreement.