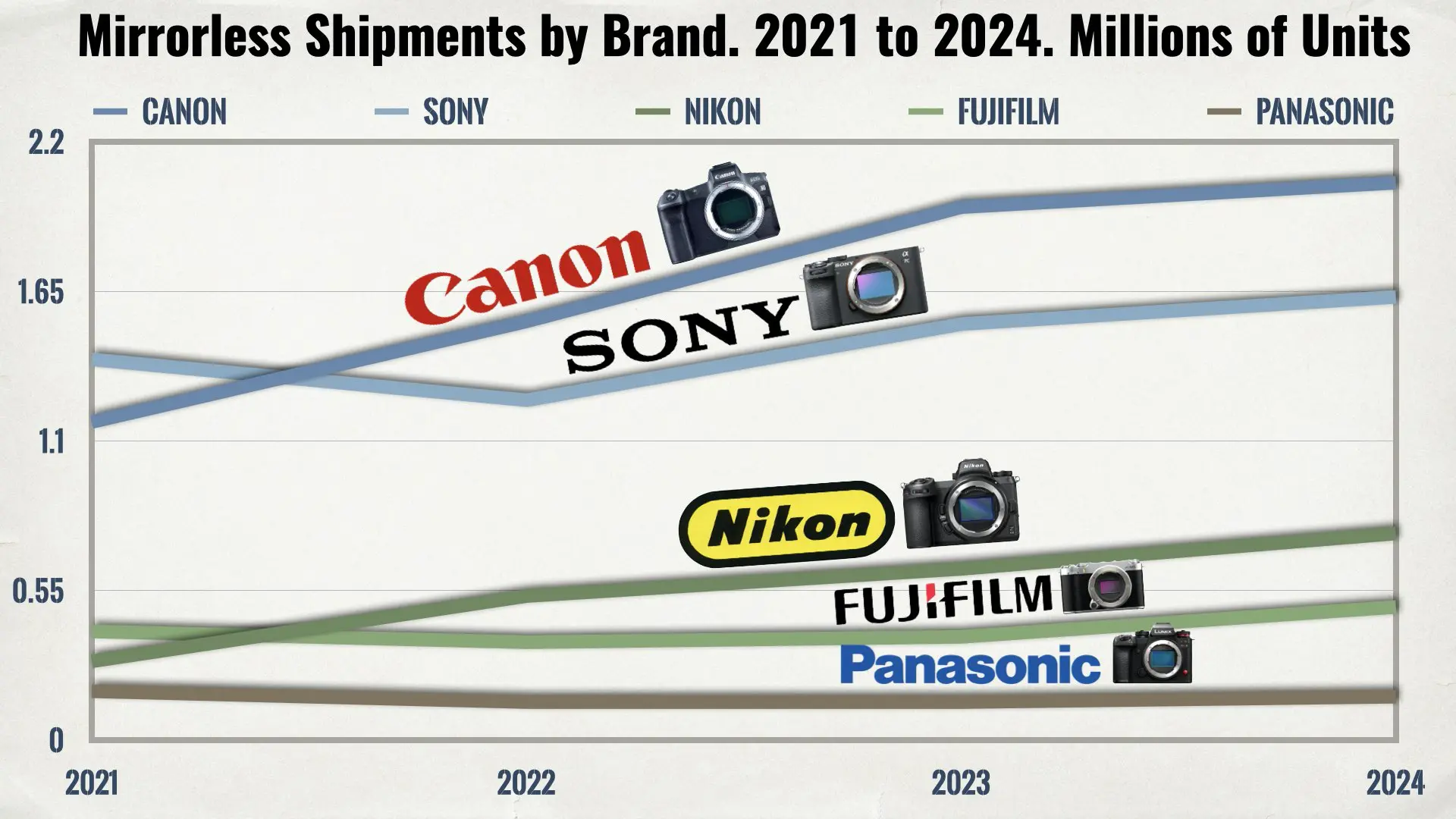

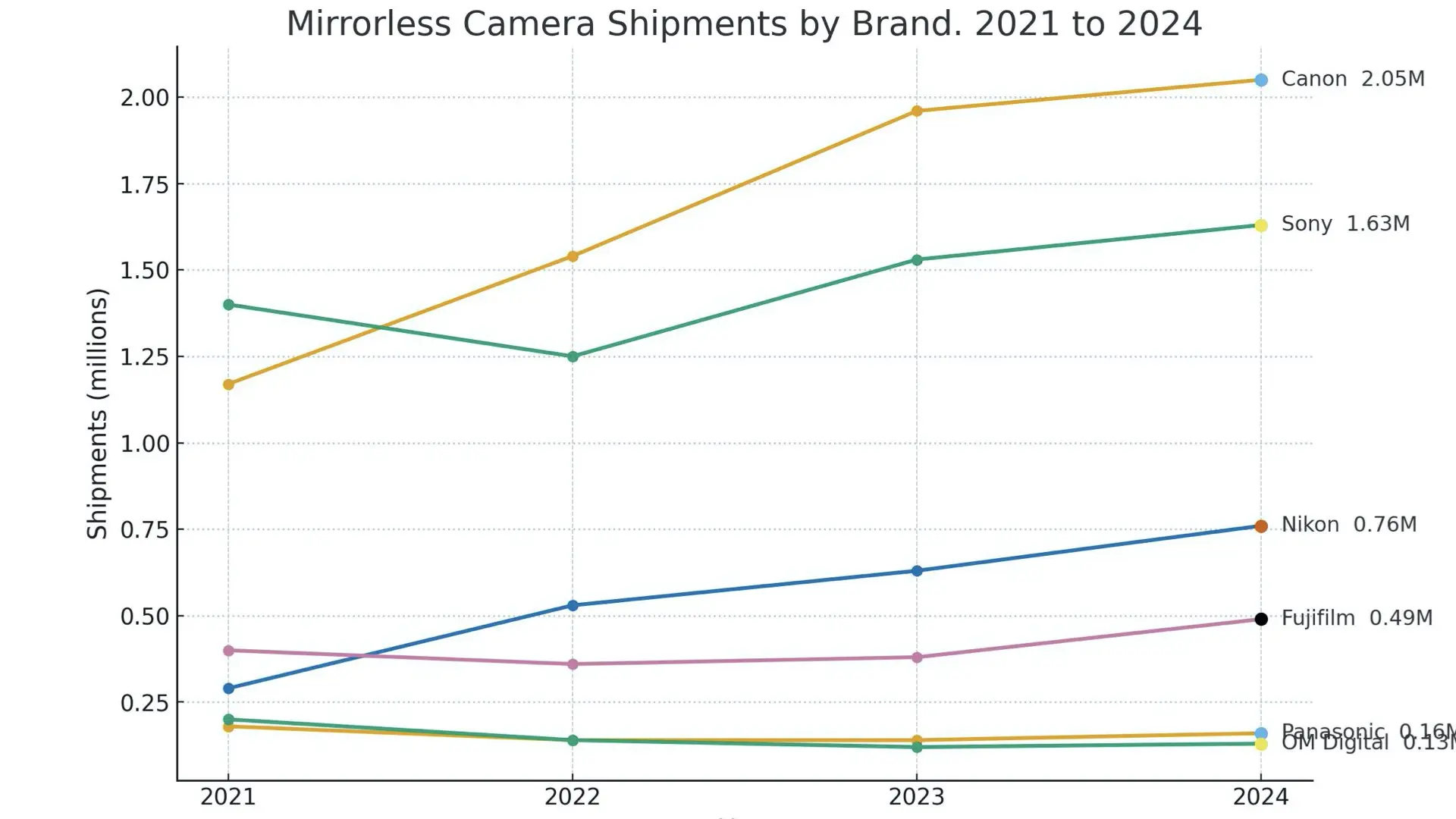

Make the story short: Canon reached 2.05M mirrorless units in 2024. Sony held at 1.63M. Nikon climbed to 0.76M. Fujifilm reached 0.49M. Panasonic and OM Digital stayed near 0.1M. These are unit shipments. Mirrorless only. Global market. Read on.

What the numbers say

-

Canon moved from 1.17M in 2021 to 2.05M in 2024. A clear multi-year rise that confirms scale and execution across tiers.

-

Sony dipped in 2022 then recovered to 1.63M in 2024. The curve is steady rather than explosive.

-

Nikon shows the sharpest climb rate among the top three, from 0.29M to 0.76M. Momentum is visible.

-

Fujifilm returned to 0.49M in 2024 after a softer 2022 to 2023.

-

Panasonic and OM Digital remained in the 0.1M range. Loyal communities. Smaller scale.

Why this matters for creators

-

Shipments indicate pipeline health. Rising shipments usually mean better availability, stronger dealer support, and faster firmware cadence.

-

Lens roadmaps follow installed base. More bodies in the field increase the incentive to release native glass and accessories.

-

Resale liquidity improves with scale. Larger ecosystems make it easier to upgrade without steep losses.

The mirrorless wave in context

The multi-year curves show mirrorless as the main stream. DSLR volume has been contracting while mirrorless continues to expand. For most buyers this means modern AF behavior, stronger video pipelines, and wider feature updates over time.

Brand by brand takeaways

Canon: Momentum and depth. Crossing 2M units reflects coverage from entry models to pro bodies. Expect continued focus on autofocus and heat management for video. Sony: Stability with a broad creator base. The next leap will likely come from sensor readout speed, thermal design, and workflow polish. Nikon: Climb confirmed. Three consecutive years of gains point to effective products and messaging. Watch for continued investment in Z-mount cine-leaning glass and color pipelines. Fujifilm: Community plus color. The 2024 rebound suggests demand for compact bodies with strong codecs and pleasing color science. Panasonic and OM digital: Focus over volume. Smaller shipment numbers do not erase engineering strengths. In specific budgets the monitoring tools, codecs, and ergonomics remain compelling. The most interesting race sits where compact mirrorless meets real cinema work. Three brands are positioned to pull the category forward. Canon. Fujifilm. Nikon. Each has different strengths, and each faces the same constraints. Heat. Readout speed. Rolling shutter. Power delivery. Audio. Monitoring. The winner will be the brand that solves these systems as a coherent package rather than as a list of features.

Canon

Canon’s momentum in shipments gives it scale, which matters for supply, firmware velocity, and the lens pipeline. On the compact side Canon already mixes strong autofocus, reliable color, and creator friendly ergonomics. To convert that into a cinema grade compact, watch for four signals. First, sustained 10 bit recording at practical bitrates without thermal cutoffs in warm environments. Second, a clean log pipeline with sensible default transforms so editors can move fast without heavy grading. Third, pro monitoring tools in body. Waveform. False color. User LUTs applied to the monitor only. Fourth, audio that does not require cages on day one. Full size ports. Solid preamps. Canon’s advantage is consistency. When Canon adds a feature it usually works exactly as advertised across the entire line. If Canon folds that discipline into a compact body that can hold 4K 60 in real shooting conditions, with dependable autofocus and stable color, it will lock in a giant slice of the one person crew market.

Fujifilm

Fujifilm’s rebound shows that the community responds to color and usability. For a cinema capable compact, Fujifilm needs to keep its signature color while improving rig free reliability. The watch list is similar but the priorities differ. Open gate options that make sense for reframing and social delivery. Consistent rolling shutter behavior across frame rates. Stabilization that plays well with walking shots and with post stabilization, not just static work. Fujifilm can also lean into tactile control. Clear top plate feedback. Lockable exposure. Fast switching between photo and video that preserves independent settings. If the company pairs its film simulations with a predictable log transform and stronger internal audio, it can give solo shooters a camera that looks finished right out of the box. That is the Fujifilm path to winning this segment. Make footage look great with minimal grading and minimal rigging, and keep the body small enough for long handheld sessions.

Sony

Sony sits on a deep sensor stack, fast autofocus, and a vast lens ecosystem. The task for 2025 is to turn that foundation into a compact that feels truly cinema ready without cages. Watch for four moves. First, faster readout that lowers rolling shutter in all key modes, including 4K 60 and 4K 120, so whip pans and kinetic blocking hold up. Second, thermal resilience that keeps rated modes for full batteries in warm conditions, with no silent downshifts. Third, monitoring and color that speed post. Waveform, false color, consistent S Log behavior, breathing compensation, and clean preview LUTs that affect the screen only. Fourth, audio and I O that remove friction. Full size ports where possible, rock solid timecode sync, and simple use of the digital audio shoe. Sony’s edge is silicon and scale. If the company couples that with clearer menus, open gate or smart oversampling paths, and internal tools that match what solo shooters need on set, it can reassert leadership in the cinema capable compact tier.

Nikon

Nikon’s climb is the most visible on the chart, and the strategic backdrop is even more important. The acquisition of RED gives Nikon control of valuable intellectual property, deep cinema experience, and a pool of engineers who have lived in high end workflows for years. The immediate advantage is clarity around compressed raw and recording pipelines. That clarity reduces legal risk and can unlock cleaner product planning. The medium term advantage is knowledge transfer. Metadata handling. Timecode behavior. Monitoring logic. Color managed pipelines that travel cleanly from set to post. If Nikon flows that know how into compact bodies, we can expect smarter internal tools and fewer edge case failures during long takes. For Nikon specifically, watch for three practical moves. First, an internal log and raw strategy that balances bitrate, card performance, and thermal load, paired with simple menus that explain the tradeoffs in plain language. Second, cinema oriented monitoring. Waveform. Vectorscope. False color. LUT slots with per clip tagging. Third, reliability. The camera should hold rated modes for entire batteries without silent downshifts. If Nikon can deliver these items, and if the lens roadmap continues to add cinema friendly focal lengths with controlled breathing and consistent focus throw, the brand will become a default choice for budget conscious crews.

Wrapping up

The broader market context matters. All three brands must ship compact bodies that can record for real durations, that can power mics and small lights through a single battery ecosystem, and that can stay cool in summer sun. Autofocus must hold faces through partial occlusion and side angles. Rolling shutter must be low enough for whip pans and kinetic blocking. Internal stabilization must not wobble edges during walking shots. None of these are headline features alone. Together they define whether a compact mirrorless can serve as an A camera. In 2025 the category winner will not be the spec sheet leader. It will be the company that turns these fundamentals into a dependable tool that a one person crew can trust every day. Canon brings scale and polish. Fujifilm brings color and community. Nikon brings fresh momentum and new advantages from the RED acquisition. The race is on.

As an Amazon Associate, Y.M.Cinema earns from qualifying purchases. If you purchase through the Amazon links above, Y.M.Cinema may earn a small commission at no additional cost to you. This helps support our work.