ARRI has issued a clear public message about its future. The company says it will continue to deliver cutting edge technology and premium services without restrictions, while remaining fully committed to its lighting business and to the high end cinema and live entertainment markets. On the surface, this reads like a reassurance post. Look closer, and it reveals something far more deliberate. ARRI is not trying to be the most popular brand in imaging. It is choosing to be the most trusted one. In other words, ARRI wants to be Rolex, not Apple.

A message shaped by the moment

ARRI’s statement arrives at a sensitive time for the film and entertainment industry. Production volume remains uneven, budgets are tighter, and competition is accelerating across every price segment. At the same time, rumors and speculation around ARRI’s long-term direction have intensified. YMCinema recently explored this broader strategic picture, examining how ARRI is positioning itself more deeply within live production, broadcast, and high reliability workflows. ARRI is signaling stability, continuity, and intent. Not expansion into new mass markets, but reinforcement of its core philosophy.

Innovation, but on ARRI’s terms

Yes, ARRI explicitly confirms continued camera development. The company states that the ALEXA family will continue to grow and that future camera technologies are in active development. This matters. ARRI is not freezing innovation but refining it. We guess we’ll see it in 2026. Historically, ARRI innovation has rarely chased headline specifications. Instead, it has focused on elements that matter over years, not product cycles. Color science consistency. Highlight behavior. Noise structure. Reliability under extreme conditions. Workflow stability across generations. This is innovation that cinematographers feel more than they read about. When ARRI talks about future camera development, it is not promising disruptive form factors or radical price changes. It is promising continuity with improvement. That is exactly what its core customers want.

Why Rolex, not Apple, is the right analogy

Apple succeeds by redefining markets through scale, ecosystem lock in, and mass adoption. Rolex succeeds by doing almost the opposite. Rolex does not chase trends. It does not rush iteration. It does not compete on price. It builds fewer products, refines them slowly, and focuses obsessively on trust, longevity, and status earned through reliability. ARRI is following the Rolex model. The company is not trying to win market share. It is protecting reference status. That is why ARRI cameras remain fixtures at major festivals, awards ceremonies, and top tier productions, even as alternatives multiply. This strategy also explains why ARRI has no interest in becoming a creator brand or a volume-driven manufacturer.

What ARRI is not trying to be

ARRI is not trying to be:

-

A prosumer camera company (we may be wrong about this one).

-

A fast iteration consumer electronics brand.

-

A resolution race participant.

-

A subscription locked ecosystem.

This was already evident when we examined why ARRI has consciously avoided entering the prosumer cinema camera space. That decision was not hesitant but was disciplined. ARRI understands that expanding downward in price almost always comes at the cost of brand clarity, support quality, and long-term trust.

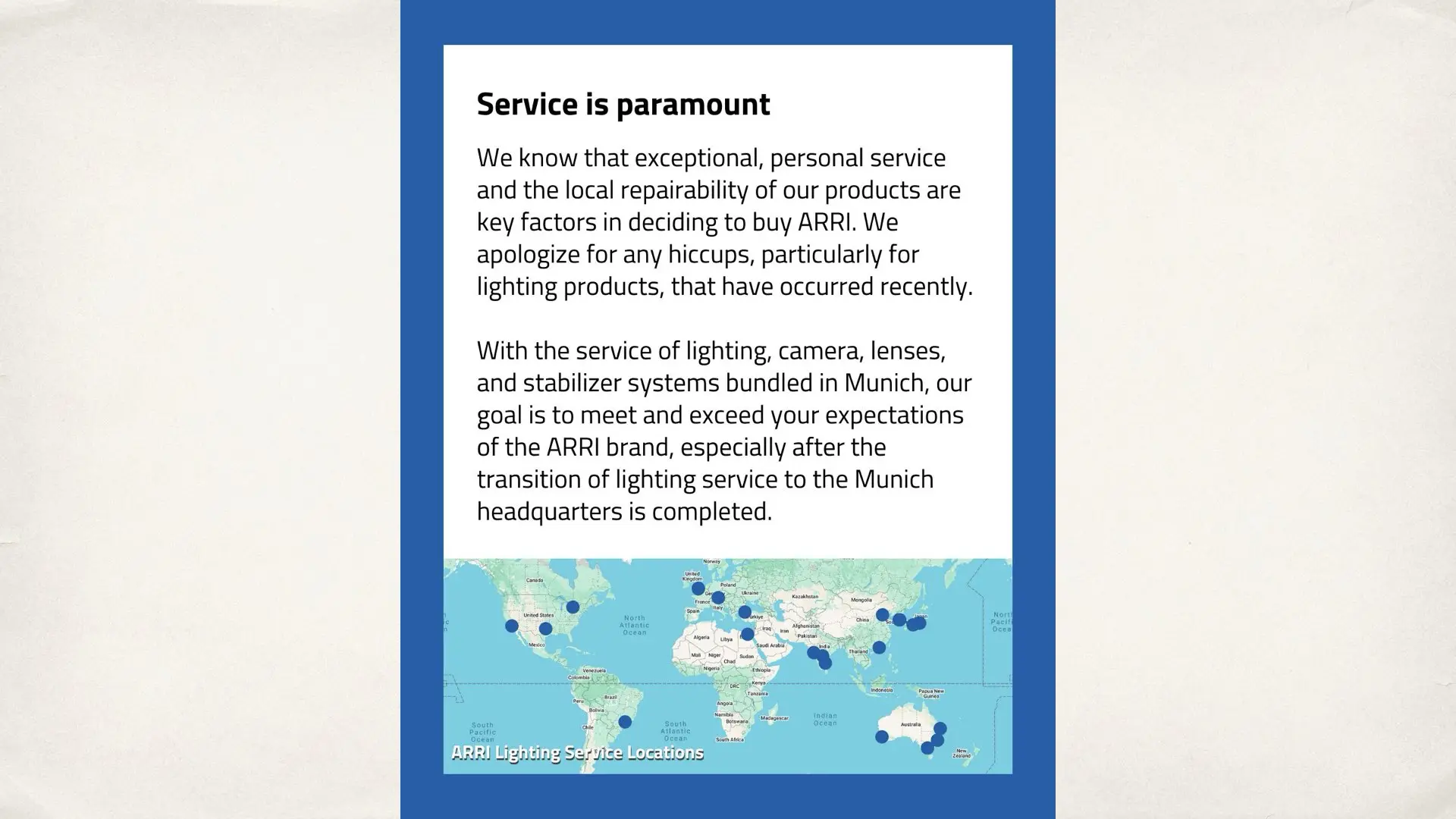

Lighting needed reassurance, and ARRI knows it

One of the strongest signals in ARRI’s message is the emphasis on lighting. ARRI explicitly apologizes for recent service hiccups related to lighting products and places strong emphasis on consolidation of lighting, camera, lens, and stabilizer service in Munich. The company also stresses that lighting remains a core pillar, with a full roadmap extending into 2026 and beyond. This is not accidental language. The lighting market is currently the most competitive and volatile segment of professional production equipment. Chinese manufacturers are innovating rapidly, prices are dropping, and product cycles are accelerating. ARRI is choosing a different path. Slower, more controlled development. In house research and development. Centralized service. Long term support. This again mirrors the Rolex mindset. Even ARRI has stated the following:

To set the record straight: ARRI is not exiting the lighting business: like many companies in the film industry, ARRI is undergoing a significant transformation to address lasting shifts in market demand while reinforcing its core strengths, and lighting remains a central pillar of our business. – ARRI

Germany, in-house, and centralized

ARRI repeatedly emphasizes that new technologies are being developed in Germany, with teams centralized in Munich. ARRI is positioning itself as engineering-driven, service-oriented, and long-term focused. Centralization improves collaboration and quality control, but it also slows iteration and increases costs. ARRI is openly accepting that tradeoff. For high end productions and rental houses, this is reassuring. Reliability matters more than novelty. One phrase in ARRI’s message stands out. Delivering technology and services without restrictions. This likely addresses concerns about software gating, licensing models, and artificial feature segmentation. At a time when many manufacturers are moving toward aggressive monetization through subscriptions or locked features, ARRI is signaling restraint. That promise reinforces trust. It also reinforces ARRI’s belief that its customers value freedom and predictability over constant change.

The long view

ARRI repeatedly references 2026 and beyond. That timeline matters. The company is preparing for its next phase carefully. In an industry obsessed with speed, ARRI is choosing patience. As said, the company is investing in future camera technologies, reaffirming its lighting business, strengthening its service infrastructure, and reinforcing its identity as the most trusted name in high-end imaging. ARRI does not want to be everywhere. It wants to be irreplaceable. That is the Rolex strategy. And for ARRI, it remains the right one. Does this approach still make sense in today’s cinema market?