Sony is reportedly considering a major strategic move: spinning off its semiconductor division, which includes its industry-leading camera sensor business. This decision, while still speculative, could have deep and lasting impacts on the filmmaking world, particularly for large sensor cinema cameras that rely heavily on Sony’s cutting-edge imaging technology. According to a report by Bloomberg, Sony may divest a majority stake in its image sensor arm—Sony Semiconductor Solutions Corp.—despite its dominant 45% market share.

The Backbone of Modern Cinematic Imaging

Sony sensors are the backbone of many flagship cinema and professional cameras. These sensors are praised for their low-light performance, color science, high dynamic range, and increasingly, their AI-enhanced capabilities. Spinning off this key division raises questions about the future direction of sensor R&D, licensing, and cost structures for camera manufacturers and filmmakers.

A Track Record of Sensor Innovation

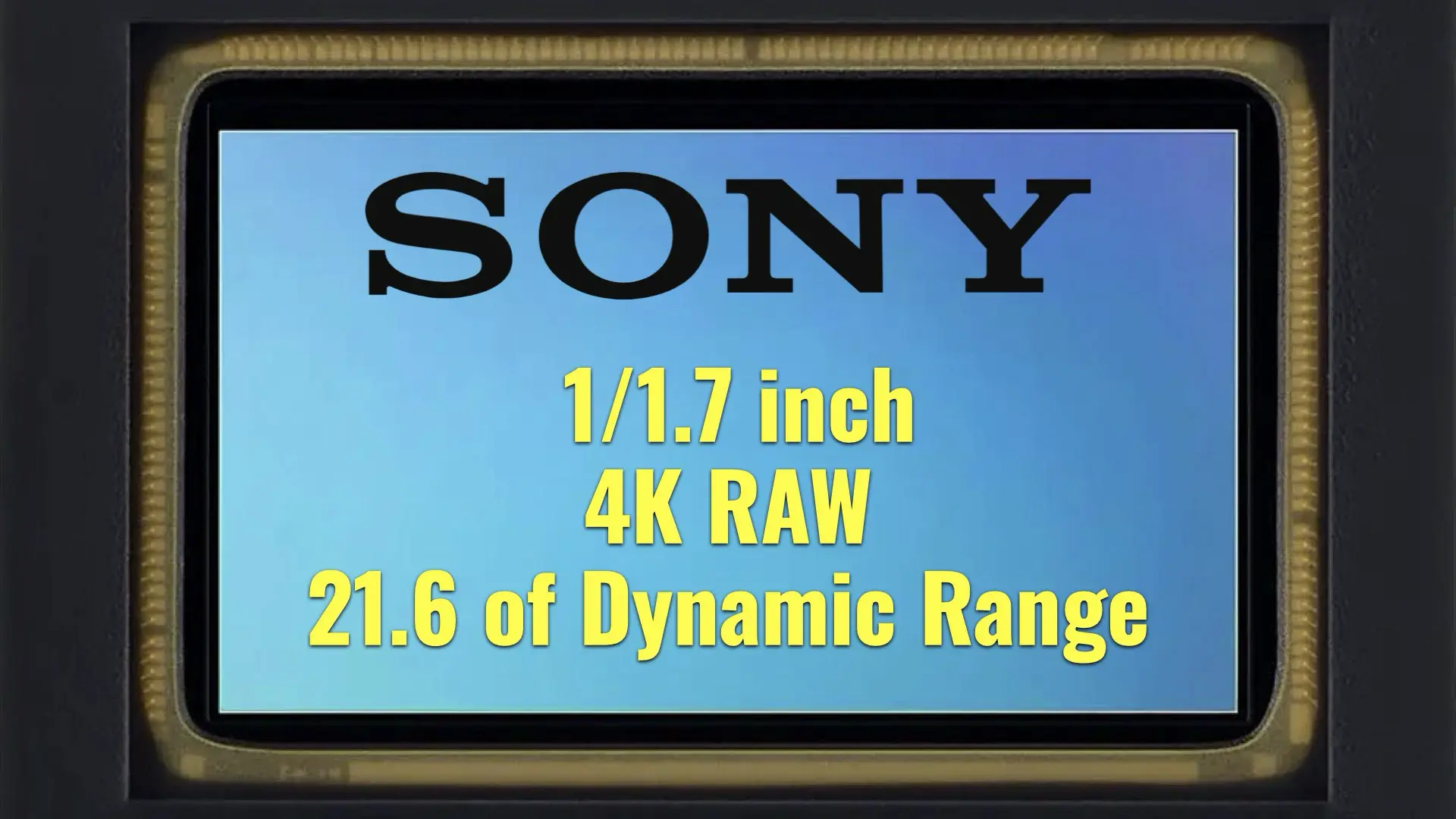

Sony has long led the charge in sensor innovation. One of the most striking examples is the development of a 247MP 19K medium format sensor, which showcases Sony’s commitment to ultra-high-resolution imaging. As reported by Y.M.Cinema in the article “Sony Developed a Medium Format 247MP 19K Sensor”, such technology is paving the way for future cinema and large-format imaging, with enormous potential for VFX-heavy films and IMAX-level quality. In addition to ultra-high resolution, Sony also pushes the boundaries of mobile imaging. For instance, its collaboration with Apple demonstrated the iPhone 15’s cinematic camera capabilities, a feat explored in “Sony Demonstrates the Potential of the iPhone 15 Camera”. The boundaries between professional and mobile filmmaking are blurring, thanks in part to Sony’s sensor leadership.

Strategic Branding and AI Integration

Sony’s ambitions extend beyond hardware. The creation of Lytia, a brand focused on mobile image sensors, shows Sony’s strategic push into AI-enhanced and computational photography. As detailed in “Sony Presents Lytia: A New Brand Name for its Mobile Image Sensors”, this initiative points to a future where imaging is defined not just by pixels, but by intelligent interpretation of visual data. Sony’s focus on high-speed imaging of large sensors has also reshaped what’s possible in filmmaking—from high frame rate capture to advanced motion tracking. Y.M.Cinema highlighted this in “Sony Aims for High-Speed Imaging of Large Sensors“, noting its importance for both narrative and documentary work.

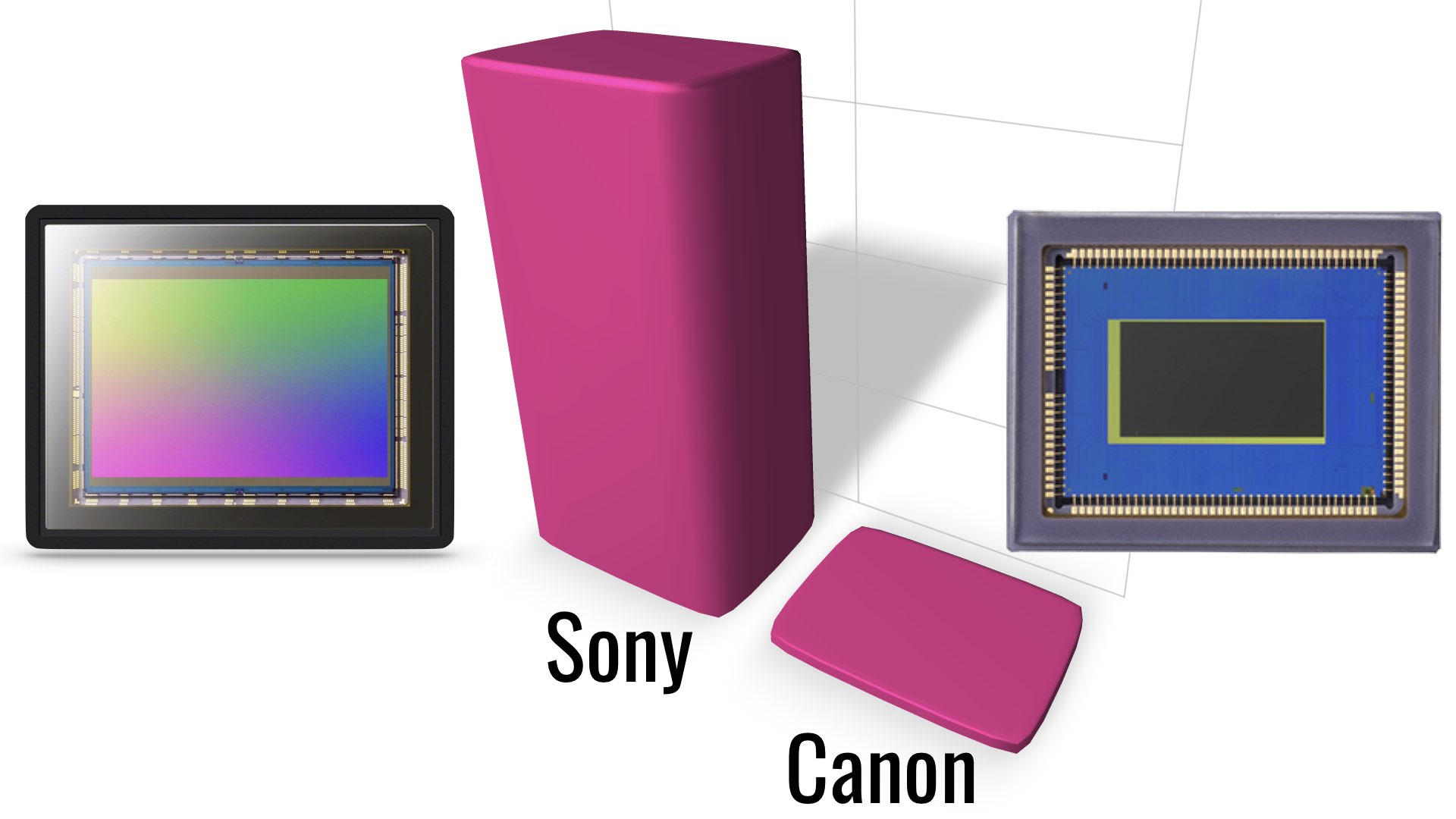

Market Dominance, Now Under Question

Despite dominating the CMOS sensor market—as emphasized in “Sony Dominates the CMOS Image Sensor World by Far“—Sony is reportedly seeing profit margins shrink. This may be due to increased competition, geopolitical trade tensions, and the capital-intensive nature of sensor development. The rumored spinoff is seen by some, including activist investor Daniel Loeb, as a way to unlock shareholder value and give the sensor division more strategic freedom.

What It Means for Filmmakers

The implications for filmmakers and manufacturers are significant. If the sensor division becomes a separate entity, camera makers might face new licensing or sourcing models. This could lead to either innovation acceleration—due to focused R&D—or disruption, if pricing and access become more restrictive. In the short term, this change might not affect the current generation of cameras. But over time, shifts in business structure often impact product development timelines, pricing, and technological direction. Independent filmmakers, production houses, and camera manufacturers will be watching this development closely.

Final Thoughts

Sony’s potential spinoff of its sensor division is more than just a corporate maneuver—it can be a potential pivot point for the future of digital filmmaking. The industry that relies on large sensor excellence may face a future where innovation speeds up or stalls, depending on how this shift plays out. For now, Sony remains at the heart of modern cinema technology—but for how long, and under what structure, remains to be seen. What are your thoughts—could Sony’s sensor spinoff help democratize filmmaking further, or will it create new barriers for innovation in high-end cinema gear regarding the most important part of the camera, which is its sensor?