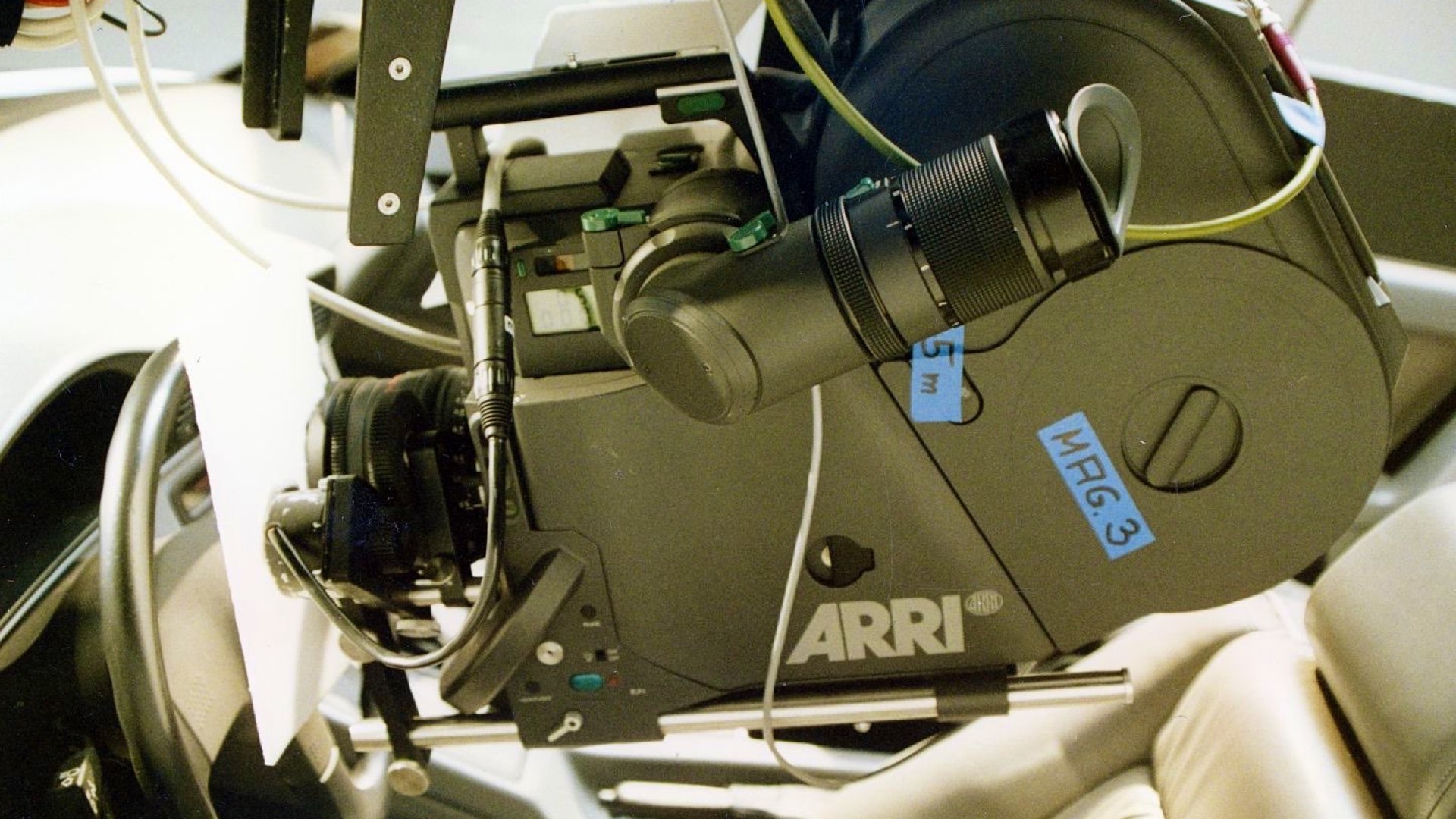

One of the most iconic names in filmmaking might be on the market. According to Bloomberg, German cinema equipment powerhouse ARRI is weighing a full or partial sale, a move that could shake the foundations of the global production landscape.

As a matter of long-standing policy, ARRI does not comment on market speculation or rumors. Like others in the industry, ARRI is currently undergoing a transformation process in which we are structurally adapting to the lasting changes in the demands of our market. In doing so, we are building on our technological expertise, our strong brand, and our long-standing commitment to our customers and partners. As we are in the midst of this transformational phase, please understand that we do not wish to comment further on this matter publicly.

– ARRI

A Cinematic Giant in Transition

Founded in 1917, ARRI has stood at the heart of cinematic history for over a century. From analog cameras to the digital ALEXA series that has powered Oscar-winning films, ARRI has defined the visual language of modern cinema. Now, as reported by Bloomberg, the Munich-based company is reportedly exploring a range of strategic options, including the sale of a minority or majority stake. The discussions, according to people familiar with the matter, are still in the early stages. No final decisions have been made, and there’s no certainty that a deal will go through. However, the fact that these conversations are happening at all signals a pivotal moment for both ARRI and the broader industry.

The Family Behind the Brand

ARRI is privately owned by the Stahl family—heirs of co-founder Robert Richter—who in 2012 acquired the remaining 50% from the heirs of the other co-founder, August Arnold. That full acquisition marked a new era of centralized leadership, but the current considerations suggest that a significant shift may now be on the horizon.

The Pressure Behind the Curtain

ARRI’s decision to evaluate its future appears to be driven by a complex set of challenges. The company has reportedly been struggling with liquidity issues due to sluggish sales and rising inventory, according to its parent company’s 2023 financial report. To manage cash flow, ARRI has already sold some non-core assets, including its Claypaky lighting division, which was acquired by EK Inc. earlier this year. This move mirrors broader trends in the production ecosystem. Just recently, Herc Holdings sold off Cinelease—its lighting and grip rental arm—after reporting a nearly 40% drop in rental revenue year-over-year. It’s clear that the post-pandemic production landscape, coupled with ongoing industry strikes and streaming-related budget cuts, is pressuring even the most established players.

Streamlining and Strategic Reassessment

ARRI is reportedly working with consulting firm AlixPartners to streamline its operations. While representatives from ARRI and AlixPartners declined to comment, the collaboration indicates that restructuring may be part of a longer-term strategy, whether or not a sale materializes.

Why This Matters

ARRI’s influence stretches from Hollywood to indie sets, from DPs to rental houses, from lighting design to camera innovation. If ARRI is sold, or even significantly restructured, it could trigger ripple effects across global film production, camera development, and rental markets. A full acquisition by a private equity firm or tech conglomerate could raise concerns about continuity, creative support, and pricing structures. On the other hand, a minority investment might inject the capital ARRI needs to thrive in an increasingly competitive environment shaped by Sony, RED (Nikon), Canon, and newer disruptors.

Update (8/8/25):

ARRI has reached out to us. This is ARRI’s comment: “As a matter of long-standing policy, ARRI does not comment on market speculation or rumors. Like others in the industry, ARRI is currently undergoing a transformation process in which we are structurally adapting to the lasting changes in the demands of our market. In doing so, we are building on our technological expertise, our strong brand, and our long-standing commitment to our customers and partners. As we are in the midst of this transformational phase, please understand that we do not wish to comment further on this matter publicly”.

Nikon do your thing again

No Blackmagic, imagine if they bought them, Alexa could be affordable

Absolutely yes!

After Nikon’s bold acquisition of RED, the idea of them stepping in again isn’t so far-fetched.

If they did grab ARRI—or even a piece of it—that would seriously change the power dynamics in pro cinema gear.

We’ve been covering this Nikon-RED momentum closely at Y.M.Cinema… and now we’re watching this space even more carefully.

Help Canon can buy it!

So after beating Red, and all tbe James Bond thing, is Red, I mean Nikon, going buy them? I’m fooling, maybe Apple, with all tbat conema camera rumor mill? Apple Arri? Sounds good.

Anyway, it’s inevitable, with too many cameras being pushed into the market, and cheap production. We all should knoo 99% of production is semi-useful/uesless over production, with the squeeze of streaming models on the other end (and devalued overadvertising, like the continual popup over advertising, even squeaking off screen here when you are trying to write). Its all heading to death defying collapse. Nikon, is one of the only one of the cheap ones with a hybrid sales approach. I was part of getting the bottom end of the market off the ground, and warned about needing a hybrid sales approach to make money early on to avoid this. But the greedy …. wanted too much in price while going after the high end, and fame and glory, burning the space without back up markets? It’s all a nuance, which the blunt instruments didn’t really seem to get! 90% of low end production goimg to land up being done on Apple products now, tbat we proven the emperor has no cloths!? All the crazies are going to get shaken out by real competitors, and there is no guarantee they will all survive either..

Nikon acquiring RED was already a major power move. If ARRI ever ends up in the hands of Nikon or even Apple (considering the wave of cinema-focused patents we’re tracking), it could redefine the industry altogether. “Apple ARRI” has a certain sci-fi ring to it, but so did “Nikon RED” until very recently.

And you’re absolutely right — the flood of gear, race-to-the-bottom pricing, and the collapsing margins of the streaming model are putting real pressure on legacy players. Add to that the democratization of production via smartphones and AI tools, and we’re watching a slow, structural unraveling of the old ecosystem.

Anyway, I hate to do this. But there is a lot of popup ads in the background chattering, even though they are not on screen. Very disruptive while you are trying to read or type, producing negative associated feelings. This just leads to a culture of rejecting advertisers, rather than safer accept advertiser advertisement systems. We all know the reject advertiser ad systems over internet and streaming systems where advertising systems are too intrusive.

I have written over the years about over advertising leading to a devaluing of advertising as people get used to ignoring the ads. Where as every advertusnebt was precious 50 years ago in responsible low advertising content, now it’s pretty much ignore thrm wholesale and resent the intrusive ones and decide not to buy that. I had expressed that if they cut the advertising 90% the ads might again get 10x+ the response. Unfortunately this has to be industry wide with a re-adjustment period for viewers to deflate their resistance. But, getting rid of the stress inducing intrusive ones will probably have quicker results.

Totally hear you, and we genuinely appreciate you taking the time to share this. 🙏

We’re very mindful of the reader experience, and we agree: ads can be overwhelming, especially when they interfere with focus or enjoyment. That said, those ads are what allow us to keep Y.M.Cinema running independently. We invest an enormous amount of time researching, writing, and publishing detailed content, especially the kind of deep dives and tech breakdowns that big sites often skip. The ad revenue helps make that possible.

That said, we’re always looking for ways to improve the balance, to support the work and keep things readable and enjoyable. Your feedback is valuable, and we’re taking it seriously as we look for more respectful ad implementations.

You system twoce lost my reply. Common misunderstanding in deign of web page. To see mistakes try small (3. 5 inch) large phone tablet android/ ios windows linux macos, and make page configuration for each.

maybe ,BMD

Blackmagic Design certainly has the ambition, agility, and product ecosystem to make a move like that. Acquiring ARRI would instantly elevate BMD into the top-tier narrative and rental space, especially in lighting and global production infrastructure, where ARRI dominates.

But the big question is: would ARRI’s high-end, precision-crafted legacy culture align with BMD’s fast-iteration, affordable-access philosophy? That merger could either be brilliant… or a philosophical clash.

Still, in a world where Nikon bought RED, anything’s possible.

In my opinion, Panasonic is the perfect match for ARRI. They are already working together with the ARRI-Log3 profile in Lumix cameras and there is probably a lot more going on behind the scenes.

It might be possible to have an ARRI-sensor in Lumix cameras (may be already in the expected S1H-II) and it also might be possible to add PDAF and IBIS-stabilization to new action and run&gun cameras from ARRI. The l-mount seems to be the best solution to get a modern, more capable, mount for independent camera companies while Nikon, Canon and Sony are restricting the usage in third party cameras.

The cooperation between Leica and Panasonic for stills has shown that this can be beneficial for both companies.

That’s a sharp take, and honestly, a Panasonic x ARRI fusion makes more sense than many realize.

The collaboration on ARRI-Log3 in Lumix cameras could very well be the tip of the iceberg. If deeper integration is already underway (sensor tech, color science, or even joint hardware), then Panasonic might be in a prime position to align more tightly with ARRI, either through strategic investment or something larger.

You’re absolutely right about the L-Mount Alliance too. In an industry where Canon, Nikon, and Sony are keeping tight control over their lens ecosystems, the L-Mount offers a much more flexible platform for innovation. An ARRI cinema camera with PDAF, IBIS, and L-mount? That would be a game-changer for solo operators and small crews.

ARRI brings heritage and precision. Panasonic brings hybrid versatility and mass production. It could be a mutually beneficial evolution…. if the philosophies match.

If you are amateur shut-up! It’s a popular believes and city legends that ARRI have its own sensors .Of course NOT.Even more,ARRI not selected best sensors from given manufacturer .And there are no color science ,no FPGA after sensor ,no debayering.All depend of the sensor .Sensor have standard set amd workflow working with it and you cannot extract much more from with with whatever FPGA tricks .YMCinema is deep amateur site that do not understand basics of Image acquisition and processing and repeat marketing nonsenses of the camera manufacturers Hollywood is not respected in the sensor amd image processing world .They made photo of the black hole bellion light years from here ,they made video how electron rotate mear nucleus – they saw Mars and deep space and you joking about skin tones and similar $#1t.

Imagine DJI buys them…

The cuts at ARRI are already deep and getting worse, long-time personnel being let go, closing and selling the Blauvelt (NY) location, and more carnage I’m sure at the mother-ship in Munich? These are drastic changes that cannot be easily reversed, and radically change the corporate culture. Trump’s ill-timed and ill-conceived tariffs are adding an additional burden for the US market, and ARRI Rentals competing against ARRI’s biggest and best clients, other rental companies, is a fatal scenario that is finally revealing itself in the shrinking production environment. The reality is that there are already enough digital cinema cameras, accessories and lights for the rest of times. The only knight on a white horse that makes sense in the comments is Apple. They’re flush with cash, but it makes no business sense, and they’re already flush with prestige. This could be the end! Where’s Mitchell Camera? Aaton? Bell & Howell? MoviCam? Photosonics? I remember when Eclair Camera went out of business too. There is precedent for these things happening.